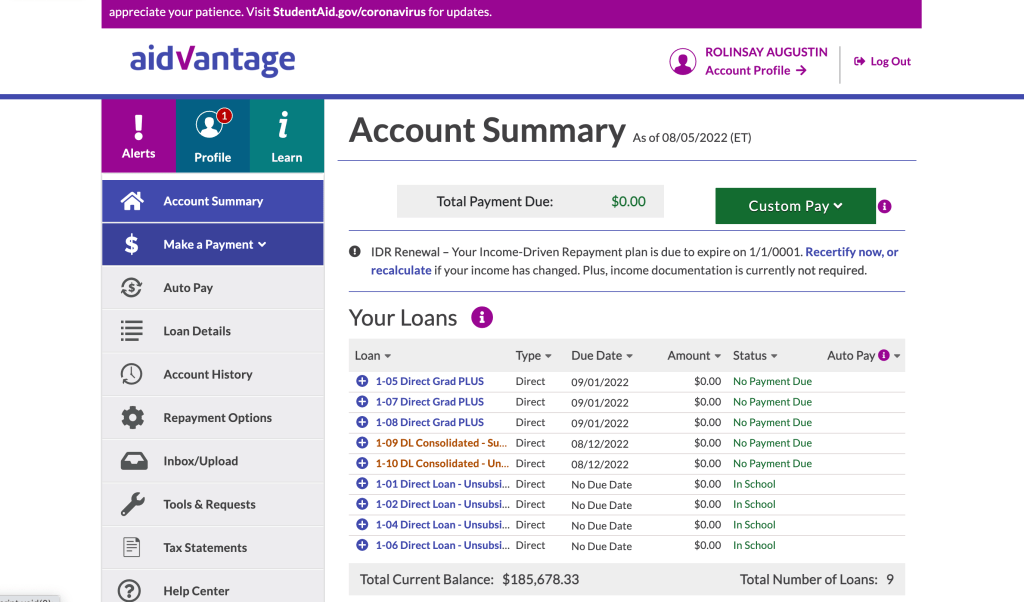

If you’ve been reading my posts, you’d already know that I graduated from CRNA school with a large amount of student debt: $287,345 to be exact. Most CRNAs in my class graduated with an average of 175-200K in student debt. If you haven’t been reading my post, you should know that the loan amount include some undergraduate loans, nurse practitioner school tuition, CRNA school tuition/ living expenses. My first payment on my loans was made on August 11th, 2021 and today, as of August 6th, 2022 , I have paid a total of $101,666 bringing my balance down to $185,678.33. If you want to read my initial blog about my post click here

https://wordpress.com/post/srnatips.blog/95

How did I manage to pay that much in exactly 12 months, here’s how:

Current balance snapshot

- CREATE A SPREADSHEET (preferably before you first paycheck)

I first created a one-page 36-month spreadsheet to see if the goal was feasible first. I created the spreadsheet before my first paycheck arrived in the bank account. The spreadsheet kept me organized and excited because you get to see the loan amount go down every two weeks. I look at the spreadsheet almost every other day to maintain a laser vision of how much I wanted to pay down for that particular month.

2. MAKE A PAYMENT EVERY PAYCHECK

I get paid biweekly so I make payments every two weeks. I schedule the payments the day before the paycheck arrives in my bank account. For example, I get paid every other Friday but I scheduled the loan payment for every other Thursday. By Friday morning the payment is already deducted from my account right after my paycheck is deposited. The purpose is to not spend the money on other things. So, I don’t give myself the options of lowering the scheduled monthly payment amount to pay other stuff, like bills. I paid on average $8500 a month making two $4000 payments every month. I make about 10K a month (net income after pre and post tax 401, insurance etc), leaving 2K /month for other expenses like school (getting my DNAP)

3. PAY DOWN HIGH INTEREST LOAN FIRST- Held off refinancing (Biden’s interest pause)

All my loans are federal loans. I paid down one out of the 10-12 loans with the highest interest rate of 7%. All my other loans were about 6%, 6.1% 6.3% etc. I did not refinance my loans because once you refinance with a private lender, you will not qualify for any federal loan forgiveness or interest rate pause. As we are still awaiting on Biden to make a decision on the student loan repayment pause, I will not be refinancing my loans at this time.

4. GET A SECOND JOB/ WORK EXTRA SHIFTS

This one is tough. You have to be highly motivated with a high desire to get out of debt quick and live your best life. At my job I get six paid vacation weeks. I scheduled my six vacation weeks during winter time and boring weeks of the year, basically when most people do not take their vacation. When more people are working, there are less chance of overtime because we are well-staffed. But in prime time, where the hospital is very busy, I work every day they would let me. This past spring and summer, I worked about 64 hours a week, almost every week, that’s 24 hours of overtime which is paid time and a half.

I did get a second job too. I know, crazy right. I work per diem at another hospital. The pay is great because they pay you to be on call at home and even if you don’t get called in you still get paid 1K, but if you do get called in, it’s 1K + whatever hours you work * 140. That’s pretty awesome right.

5. LIVE OFF YOUR BOYFRIEND/SPOUSE/ FIANCE / PARENTS

90% of my paycheck goes to my loans. I didn’t buy a fancy car, house, etc. because I knew I wanted to get rid of my student loans first. My fiance pays for literally everything: rent, food, utilities, gas, vacation, etc. I pay for a few things here and there but he is mainly the person spending. He is happy to help me get the debt down but I am grateful that he does and I make sure I make him feel appreciated every time I make a payment. I promised him I will pay the first two years of our mortgage alone as my pay back.

In conclusion, if paying down your loans doesn’t feel dumb, annoying, painful sometimes, you are not doing it right. It requires a lot of sacrifices, from you and your family. I am hoping to be down to 130K by the end of this year. I will keep you all posted.

Hi Linsay, can you be my mentor. I too have an extremely similar journey as you. I started icu had some issues went to Med surg then completed AG-ACNP program, still had CRNA school my mind. Took me five years to get back to icu, as they kept denying my application finally a fellow and plan to apply to CRNA school by next year.

LikeLike

Thank you for reaching out, Jasmine. I would love to be your mentor and give you some advice and insights. NP school and CRNA school are different. In a nurse practitioner program, you mostly learn medical management which is different from anesthetic management. Let me know where you are in your application journey.

LikeLike

Hi Lindsay,

thank you for your posts. It was encouraging and inspiring to read your story. I need a mentor too, I guess. I just turned 34, two small kids, marriage problems, a bit over 1 year of ICU experience and the experience was horrible thus far. I am feeling so drained, I don’t know if I can get through the admission process. I was torn apart in the ICU, I hated my unit. I loved some doctors, but absolutely hated the unit. I am starting a new ICU job next week, and I am in so much doubt. I don’t know that it’s worth it. I can’t take more negativity.

LikeLike

Hi Linsay! I was wondering if I would be able to contact you with some questions, as my journey is very similar to yours. I live in South Florida and was looking at Keiser University as well for CRNA school. Please let me know if I can reach out! Thank you 🙂

LikeLike

HI, thanks for reaching out. Sorry I have been super busy. Keiser University is a great school and I am glad I went there. PM me if you have any specific questions. Let me know if you can.

LikeLike

I also am in the same boat. I have been an NP for almost two years and still 10 years later I have CRNA on the brain. I tried to fool my heart’s true desire into thinking a form of APN would suffice, I was wrong. I would love to see how you both are faring with everything! ❤

LikeLike