Hello friends,

Hello friends,

It’s been a while, and I have so much to share—I hardly know where to begin. Life has been incredibly busy, as I’m sure it has been for all of us, so I’ll spare you the unnecessary details. To catch myself up, I even had to revisit my previous posts!

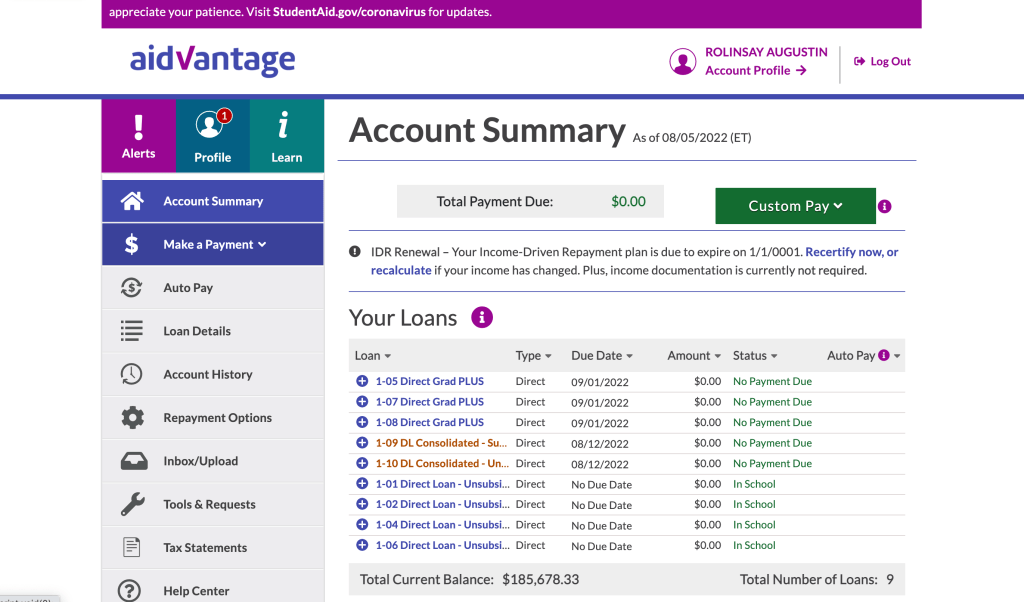

Recap of my last post: Federal student loan balance as of August 2022.

If you haven’t read it yet, check out my previous post, “How I Paid Off $100K of My $287K Student Loans in 12 Months,”where I detailed my loan repayment strategy. Back in August 2022, I shared this picture showing my federal student loan balance at $185,678.33—a significant milestone after paying off $100K of my original $287,345 balance.

How I paid off 100K out of my 287K student loans in 12 months

Well, today I am proud to say that I have stuck to the plan (well kinda). After my graduation in May 2021, I started with a total federal student loan balance of $287,345. I did say that I would pay it off in 36 months which would have been August 2024. I fell short since 40 months later (December 2024) I still have a balance of $56,953. However, I am super proud of how much I have paid off.

I totally underestimated interests, and really, life in general.

Let me explain

Credit Cards

I paid off 10K in credit card debts. I used to have 14 credit cards, but now I’ve streamlined to just three: Apple, Capital One, and Chase. I came to realize that having so many credit cards was disrupting my financial plans and goals. Honestly, who needs 14 credit cards, let alone the time to manage them all? Now, I no longer carry a balance and rarely use my credit cards—only for significant purchases where earning 2% cash back might save me around $20 on weekly hospital cafeteria expenses.

Back Taxes

Here’s a big one: Between 2014 and 2020, I accumulated back taxes that kept growing with interest over the years. By the time I graduated from CRNA school in 2021, my balance with the IRS had ballooned to a staggering $50,000—ouch. Everyone I consulted strongly advised me to pay it off as quickly as possible, so I did. I tackled the entire $50K, and I’m proud to say I now have a $0 balance with the IRS. Moving forward, I fully intend to keep it that way!

GOT MARRIED !!!

Here’s another big update—I tied the knot! And let me tell you, it wasn’t cheap. As you may remember, my fiancé (now husband) is also a CRNA. I’d always dreamed of a grand wedding: stunning real flowers, designer shoes, a show-stopping dress—you can probably see where this is headed. The price tag? A whopping $110K for an unforgettable celebration at The Palace in Somerset, NJ. It was an absolutely beautiful day, one I wish I could relive over and over.

While $110K vanished in just one night, we did receive $40K in monetary gifts from our guests. We had requested cash gifts instead of a traditional registry since we didn’t own a home at the time. It was a day to remember, and every penny was worth it!

LAST UPDATE

I went from Full time W-2 CRNA to 1099 Locum Tenens CRNA. Oh yeah, it was a big deal. I will have an entire post about it and how good and messy it can be so stay tuned.

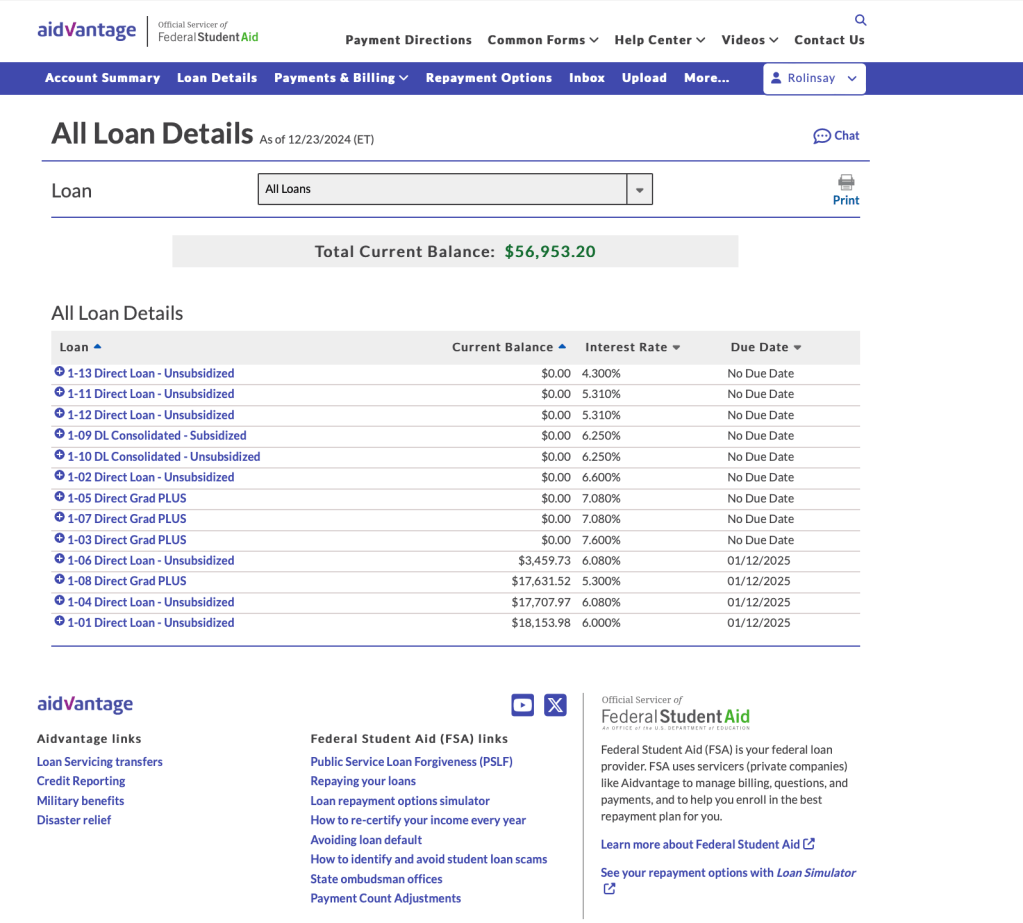

Here’s my CURRENT LOAN BALANCE updated sheet

I used the avalanche method to pay off my loans (pay the loans with highest interest first). I am anticipating finishing paying off my $56K balance by March 2025, fingers crossed.

I hope this can somehow motivate you to go to school and not worry about the big loan balance that comes with CRNA school. Tip: Last year I, alone, also made $357K. If you stay organize , and don’t have a lavish unnecessary wedding, 36 months is more than enough time to pay off all your loans.

So to summarize here’s all I’ve paid:

Loans 129K

Credit Cards $10K

Back taxes $50K

Wedding $40K (my contribution)

That’s a whopping $100K that could have gone toward my student loans. However, I do believe those expenses were necessary. Recently, I started listening to The Ramsey Show podcast, and it’s been an eye-opener in helping me redefine my financial goals. I’m thrilled to be making significant progress in eliminating my debts with relentless determination!

Comments welcome!